Identifying prospects actively researching your solutions transforms sales and marketing effectiveness. B2B intent data providers deliver precisely this capability—revealing which companies are in-market for your products or services before competitors reach them. This comprehensive comparison examines the top 15 intent data platforms, evaluating features, pricing, data sources, and ideal use cases to help you select the perfect solution for your organization.

Understanding B2B Intent Data

Intent data tracks digital behaviors signaling purchase readiness. When prospects research specific topics, consume related content, or engage with competitive information, they generate intent signals. The best B2B intent data providers aggregate these signals from multiple sources, applying sophisticated algorithms to identify accounts demonstrating genuine buying interest.

Three primary intent data types exist:

1st Party Intent Data

- Collected directly from your own digital properties (websites, content downloads, etc.).

- Captures user behavior and interactions within your owned channels.

2nd Party Intent Data

- Data shared through partnerships with other organizations.

- Enhances your own data by incorporating additional insights from trusted partners.

3rd Party Intent Data

- Aggregated from external sources, such as publishers, communities, or third-party networks.

- Provides broader insights from outside your direct control.

Elite Intent Data

- Comprehensive data derived from a wide array of sources.

- Includes advanced analytics and broad network aggregation for higher accuracy in intent detection.

Intent-Enriched Data

- Raw intent data enhanced with additional context.

- Provides deeper insights that enable highly targeted marketing and sales efforts.

Top 15 B2B Intent Data Providers Compared

1. Bombora (Company Surge®)

Overview: Industry-leading third-party intent data provider with the largest cooperative data exchange network.

Data Sources: 4,000+ B2B websites in cooperative network, 12+ million companies tracked

Key Features:

- Company Surge® intent signals across 10,000+ topics

- Deep integration with major MAPs and CRMs

- Account-level and contact-level intent scoring

- Industry-specific intent taxonomies

- Data compliance and privacy protection

Pricing: Custom pricing based on data volume and integrations (typically $20,000-$100,000+ annually reported by users)

Best For: Enterprise organizations requiring comprehensive third-party intent coverage

Pros: Largest data cooperative, excellent data quality, extensive integrations, transparent methodology

Cons: Premium pricing, implementation complexity, learning curve for optimization

2. 6sense

Overview: AI-powered account engagement platform with proprietary intent data and predictive analytics.

Data Sources: Proprietary data network, third-party partnerships, first-party integration

Key Features:

- Predictive account identification

- Multi-channel campaign orchestration

- Anonymous visitor identification

- AI-driven insights and recommendations

- Account journey mapping

Pricing: Custom pricing (typically $50,000-$300,000+ annually based on features and scale reported in industry reviews)

Best For: Mid-market to enterprise B2B companies with complex sales cycles

Pros: Comprehensive ABM platform, strong AI capabilities, excellent predictive accuracy, robust analytics

Cons: Significant investment required, implementation complexity, may include features beyond intent data needs

3. ZoomInfo

Overview: B2B contact database with integrated intent signals and sales intelligence.

Data Sources: Proprietary web crawling, Streaming Intent data partnerships, community contributions

Key Features:

- 200+ million business contacts

- Scoops (real-time company news and triggers)

- Conversation Intelligence

- Website visitor tracking

- Chrome extension for prospecting

Pricing: Starts around $15,000 annually for basic plans, scales with user count and features (based on user-reported pricing)

Best For: Sales teams needing combined contact data and intent signals

Pros: Comprehensive contact database, user-friendly interface, extensive data coverage, strong sales workflows

Cons: Data accuracy varies, intent data less mature than dedicated providers, contract commitments

4. Demandbase

Overview: Account-based marketing platform with integrated intent data and advertising capabilities.

Data Sources: First-party data, third-party partnerships, advertising network data

Key Features:

- Account identification and scoring

- Personalized website experiences

- Display advertising orchestration

- Sales intelligence integration

- Engagement analytics

Pricing: Custom pricing (typically $40,000-$200,000+ annually reported by users)

Best For: B2B companies prioritizing account-based advertising and personalization

Pros: Strong advertising capabilities, comprehensive ABM features, good integration ecosystem

Cons: Premium pricing, complexity for smaller organizations, advertising focus may not suit all needs

5. Terminus

Overview: Multi-channel ABM platform with intent data integration and advertising orchestration.

Data Sources: Third-party intent partnerships (Bombora integration), first-party data

Key Features:

- Multi-channel campaign execution

- Account-based chat

- Email signature marketing

- Display and LinkedIn advertising

- Attribution reporting

Pricing: Starts around $25,000 annually, scales with features and channels (user-reported estimates)

Best For: Marketing teams executing multi-channel ABM campaigns

Pros: User-friendly interface, strong campaign execution, good customer support, flexible channel mix

Cons: Relies on third-party intent data partnerships, mid-market feature depth, integration limitations

6. Cognism

Overview: Sales intelligence platform with global contact data and intent signals.

Data Sources: Web crawling, phone-verified contacts, GDPR-compliant EU data

Key Features:

- Phone-verified mobile numbers

- Intent data integration

- Technographic data

- European data compliance

- Chrome extension

Pricing: Custom pricing based on user count and data access, typically $12,000-$50,000+ annually

Best For: International sales teams, particularly those targeting European markets

Pros: Strong European coverage, phone-verified data, GDPR compliance, good data accuracy

Cons: Intent capabilities less developed than specialized providers, primarily contact-focused

7. TechTarget Priority Engine

Overview: Purchase intent data from technology-focused content consumption and research activities.

Data Sources: TechTarget’s network of 140+ technology-specific websites and publications

Key Features:

- Technology buyer intent signals

- Content consumption tracking

- Research-level behavioral data

- Active prospect identification

- Industry-specific insights

Pricing: Custom pricing based on data volume and topics, typically $30,000-$150,000+ annually

Best For: Technology vendors and IT service providers

Pros: Deep technology buyer insights, high-quality behavioral data, niche focus provides specificity

Cons: Limited to technology vertical, smaller data universe than generalist providers, premium pricing

8. LeadSift

Overview: B2B social media intent data provider tracking public social conversations and engagement.

Data Sources: Public social media platforms, forums, and online communities

Key Features:

- Social media intent monitoring

- Competitive intelligence tracking

- Topic-based signal identification

- Real-time alerts

- Audience segmentation

Pricing: Custom pricing, typically $15,000-$60,000+ annually

Best For: Organizations prioritizing social selling and community engagement

Pros: Unique social data perspective, early-stage intent detection, competitive monitoring

Cons: Social signals may be less qualified, data volume varies by industry, integration limitations

9. Lusha

Overview: Contact enrichment and prospecting tool with basic intent capabilities.

Data Sources: Web scraping, public sources, community contributions

Key Features:

- Browser extension for prospecting

- Contact enrichment

- Job change alerts

- Basic intent signals

- CRM integration

Pricing: Starts at $29/month per user, scales to custom enterprise pricing

Best For: Small to mid-market sales teams with basic intent needs

Pros: Affordable entry point, easy to use, quick implementation, good for SMB

Cons: Limited intent sophistication, primarily contact-focused, accuracy varies

10. Span Global Services

Overview: SPAN delivers customized intent-enriched datasets for campaigns, enabling businesses to power their GTM strategies without the complexity and overhead of predictive SaaS engines.

Data Sources: Aggregates intent data from multiple sources, focusing on high-quality, relevant signals that are tailored to specific campaign needs.

Best Use Case: Ideal for companies seeking intent-driven go-to-market strategies without the burden of ongoing SaaS platform costs and complexity.

Key Features:

- Customizable intent data

- Actionable datasets

- Immediate use

- Campaign-focused

- Real-time data

Pros: Customizable, cost-effective, actionable, scalable, ideal for medium to large data sets

Cons: Semi automated, Limited Advanced Analytics, Re-assessing data sets periodically

Pricing Indicator: $10K-$50K+*

Implementation: Simple

11. Madison Logic

Overview: Account-based marketing platform with proprietary intent data from content syndication network.

Data Sources: Content syndication network, research engagement tracking, advertising data

Key Features:

- Content consumption intent signals

- Research-level engagement tracking

- Account identification

- Multi-channel activation

- ABM campaign execution

Pricing: Custom pricing based on campaigns and data access, typically $40,000-$150,000+ annually

Best For: B2B marketers running content syndication and demand generation campaigns

Pros: High-quality content engagement data, strong campaign execution, comprehensive ABM features

Cons: Higher pricing tier, content syndication focus may not suit all strategies, implementation complexity

12. Clearbit

Overview: Real-time data enrichment platform with visitor intelligence and basic intent signals.

Data Sources: Web crawling, machine learning enrichment, third-party partnerships

Key Features:

- Real-time company and contact enrichment

- Website visitor identification

- Form optimization with progressive profiling

- Advertising audience building

- API-first architecture

Pricing: Starts around $3,000-$5,000 annually for basic plans, scales significantly with usage

Best For: Product-led growth companies and technical teams valuing API integration

Pros: Excellent enrichment accuracy, strong API, good for PLG models, developer-friendly

Cons: Intent capabilities limited, primarily enrichment-focused, usage-based pricing can escalate

13. D&B Hoovers (Dun & Bradstreet)

Overview: Business intelligence platform combining firmographic data with intent insights.

Data Sources: D&B’s proprietary business database, partnership data, web monitoring

Key Features:

- Comprehensive firmographic data

- Financial health indicators

- Relationship mapping

- News and trigger alerts

- Predictive analytics

Pricing: Custom pricing based on user count and data access, typically $15,000-$100,000+ annually

Best For: Enterprise sales teams requiring financial intelligence and risk assessment

Pros: Unparalleled firmographic depth, global coverage, financial insights, established brand

Cons: Intent capabilities less sophisticated, interface complexity, higher cost, legacy platform feel

14. G2

Overview: Software review platform offering buyer intent data from review research activities.

Data Sources: G2.com software research and review activity

Key Features:

- Software category research intent

- Competitive comparison tracking

- Review engagement monitoring

- Integration with sales/marketing tools

- Account-level research signals

Pricing: Starts around $15,000 annually for intent data access, scales with features

Best For: Software vendors with G2 presence seeking high-intent buyers

Pros: High purchase intent signals, software-specific focus, competitive intelligence, authentic user interest

Cons: Limited to companies researching software on G2, narrow focus, dependent on category traffic

15. HubSpot Sales Hub (with third-party integrations)

Overview: CRM and sales platform with intent data through marketplace integrations.

Data Sources: First-party HubSpot data, third-party intent provider integrations

Key Features:

- Native first-party intent tracking

- Email tracking and notifications

- Meeting scheduling

- Pipeline management

- Integration marketplace for intent data

Pricing: Sales Hub starts at $45/month per user (Starter), Professional at $450/month (3 users), Enterprise at $1,200/month (5 users)

Best For: Small to mid-market companies already using HubSpot ecosystem

Pros: Affordable for existing HubSpot users, excellent first-party intent, user-friendly, strong ecosystem

Cons: Native intent limited to first-party, requires additional integration for comprehensive intent, feature limitations in lower tiers

Intent Data Platform Comparison Table

| Provider | Data Type | Best Use Case | Pricing Indicator | Implementation |

| Bombora | Third-party | Enterprise intent coverage | $20K-$100K+* | Complex |

| 6sense | Multi-source | Predictive ABM | $50K-$300K+* | Complex |

| ZoomInfo | Contact + Intent | Sales intelligence | $15K+* | Moderate |

| Demandbase | Multi-source | ABM advertising | $40K-$200K+* | Complex |

| Terminus | Third-party partnership | Multi-channel ABM | $25K+* | Moderate |

| Cognism | Contact + Intent | International sales | $12K-$50K+* | Moderate |

| TechTarget | Publisher network | Technology buyers | $30K-$150K+* | Moderate |

| LeadSift | Social media | Social selling | $15K-$60K+* | Simple |

| DealSignal | Verified data | Data accuracy | $10K+* | Simple |

| Lusha | Contact enrichment | SMB prospecting | $29/month | Simple |

| SPAN | Contact enrichment | Custom intent-Driven | $10K-$50K+* | Simple |

| Madison Logic | Content syndication | Content marketing | $40K-$150K+* | Moderate |

| Clearbit | Enrichment | Product-led growth | $3K-$5K+ | Simple |

| D&B Hoovers | Firmographic | Financial intelligence | $15K-$100K+* | Complex |

| G2 | Review platform | Software vendors | $15K+* | Simple |

| HubSpot | First-party | HubSpot ecosystem | $45/month | Simple |

Note: Pricing ranges marked with * are approximate based on user reports and industry reviews. Most providers use custom pricing models. Contact vendors directly for accurate quotes.

How to Choose the Right Intent Data Provider

Evaluate Your Buyer Journey Complexity Complex enterprise sales cycles with multiple stakeholders benefit from comprehensive platforms like 6sense or Demandbase. Transactional sales may succeed with simpler solutions like Lusha or Clearbit.

Assess Your Existing Tech Stack Integration capabilities matter significantly. If you’re invested in Salesforce, prioritize providers with native integrations. HubSpot users might leverage their ecosystem before adding external tools.

Define Your Data Volume Needs Enterprise organizations tracking thousands of accounts require robust data coverage from providers like Bombora or ZoomInfo. Smaller focused account lists might succeed with niche providers like G2 or TechTarget.

Consider Industry Specificity Technology companies benefit from TechTarget’s deep tech buyer insights or G2’s software research data. Generalist providers suit diverse industry targets.

Budget Realistically Enterprise platforms require significant investment ($50K-$300K+) plus implementation resources. SMBs should explore Lusha, Clearbit, or HubSpot’s native capabilities first.

Prioritize Data Quality Over Volume More data doesn’t always equal better results. Providers like DealSignal emphasize accuracy over quantity, reducing wasted sales effort on incorrect information.

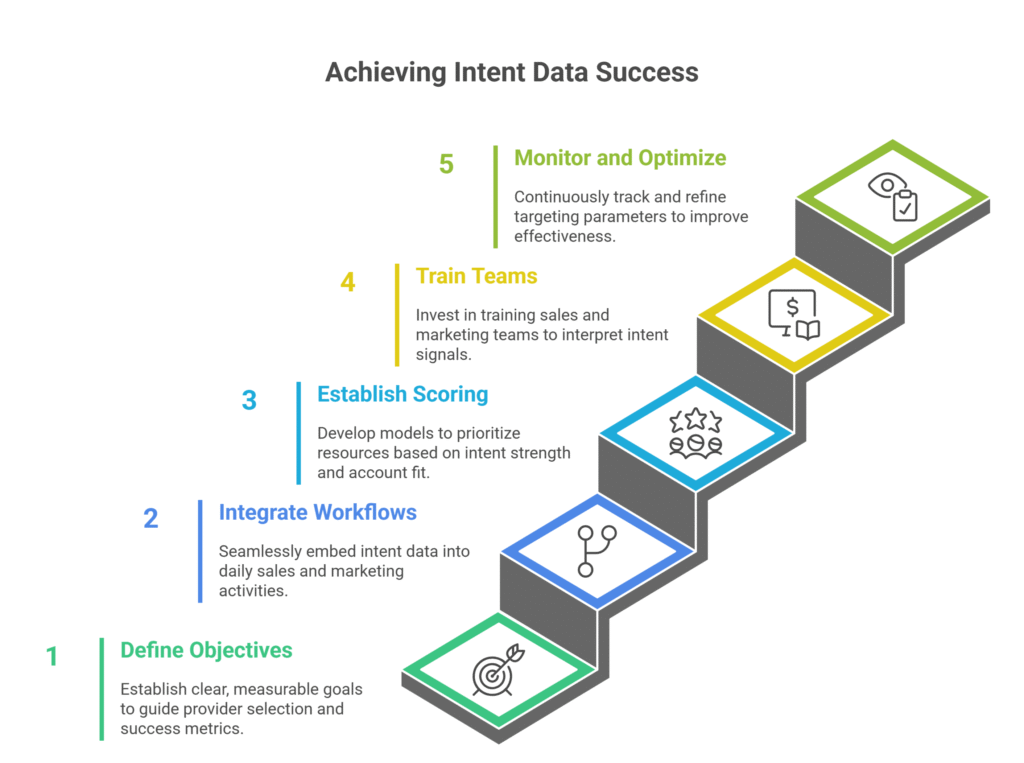

Implementation Best Practices

The Future of B2B Intent Data

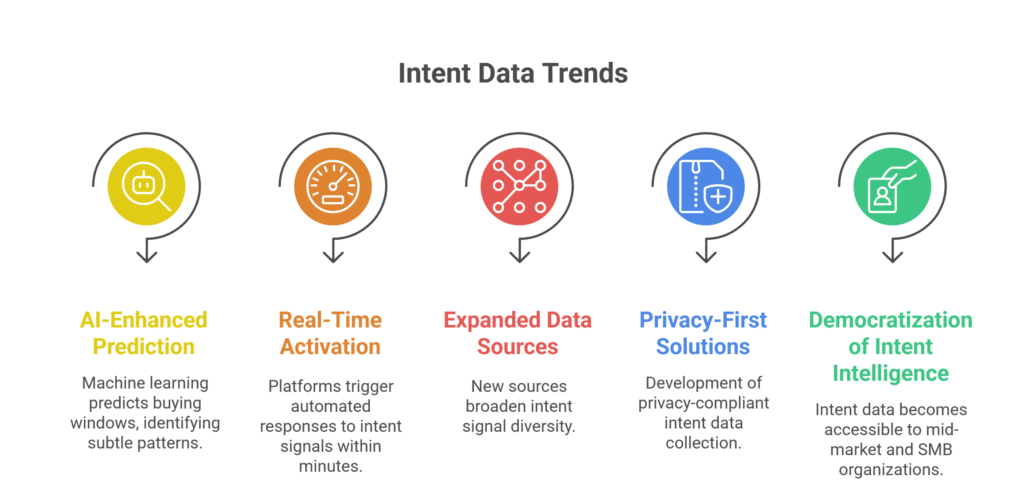

Intent data technology continues advancing rapidly. Emerging trends include:

Making Your Decision

Selecting the ideal B2B intent data provider requires balancing multiple factors—data quality, coverage breadth, integration capabilities, pricing, and vendor support. Enterprise organizations with complex needs and substantial budgets might choose comprehensive platforms like 6sense, Bombora, or Demandbase. Mid-market companies often succeed with ZoomInfo, Terminus, or industry-specific providers like TechTarget. Smaller organizations should consider Lusha, Clearbit, or HubSpot’s native capabilities.

For organizations prioritizing international reach and verified data accuracy, specialized providers like Span Global Services deliver exceptional value. Companies needing precision-targeted lists with integrated intent signals may find Lake B2B’s approach more aligned with their campaign requirements than broad intent monitoring platforms.

The best provider aligns with your specific sales motion, target audience, existing technology infrastructure, and growth objectives. Most vendors offer trials or pilot programs—leverage these to evaluate data quality and workflow fit before committing.

Intent data transforms B2B sales and marketing from reactive outreach to proactive engagement with in-market buyers. The right platform identifies prospects actively researching solutions, enabling timely conversations that convert interest into revenue. Invest time in thorough evaluation, and your chosen intent data provider will become an indispensable competitive advantage in your go-to-market strategy.

Frequently Asked Questions

What is B2B intent data?

B2B intent data tracks digital behaviors signaling purchase interest, revealing which companies are actively researching specific topics, solutions, or competitors. It helps prioritize accounts showing genuine buying intent.

How much do intent data platforms cost?

Pricing ranges dramatically from $29/month for basic tools like Lusha to $300,000+ annually for enterprise platforms like 6sense. Most B2B intent data providers charge $15,000-$100,000+ annually depending on features and scale.

What’s the difference between first-party and third-party intent data?

First-party intent comes from your own website and marketing channels, showing engagement with your brand. Third-party intent aggregates research behaviors across external publisher networks, identifying prospects before they visit your site.

Can small businesses afford intent data?

Yes. Affordable options include Lusha ($29/month), Clearbit (starting around $3,000 annually), and HubSpot’s native intent tracking. These provide valuable insights without enterprise-level investment.

Which intent data provider is most accurate?

Accuracy varies by use case. Bombora leads in third-party intent breadth, 6sense excels in predictive accuracy, TechTarget provides high-quality technology buyer signals, and DealSignal emphasizes contact data accuracy guarantees.

People Also Ask

How does intent data work?

Intent data platforms track content consumption, research activities, and digital behaviors across publisher networks or specific platforms, using algorithms to identify accounts demonstrating buying interest in specific topics or solutions.

Is intent data worth the investment?

For most B2B companies, yes. Intent data typically improves lead quality, reduces sales cycle length, and increases conversion rates by 20-40% by focusing resources on in-market accounts rather than cold outreach.

What industries benefit most from intent data?

Technology, financial services, healthcare, manufacturing, and professional services see strong ROI. Any industry with considered B2B purchases, multiple decision-makers, and longer sales cycles benefits significantly.

How is intent data collected ethically?

Reputable providers use opt-in publisher networks, anonymize individual user data, aggregate signals at company level, and comply with GDPR, CCPA, and privacy regulations. Always verify provider compliance.

Can I combine multiple intent data sources?

Yes, and it’s often recommended. Combining third-party intent (Bombora), first-party data (your website), and contact intelligence (ZoomInfo) provides comprehensive buyer visibility and higher signal confidence.